The BCG growth share matrix is a simple conceptual framework for resource allocation within a firm

1. Background to the BCG matrix

IN 1968, BCG developed the growth share matrix, which is a simple conceptual framework for resource allocation within a firm.

2. Purpose of the BCG matrix

The BCG matrix is a simple tool that enables management to:

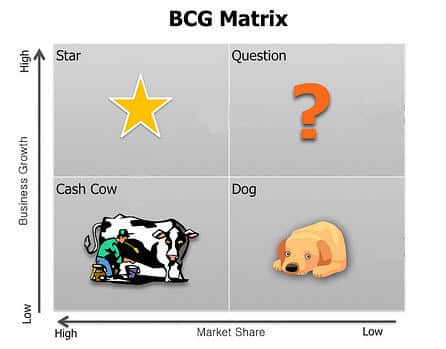

- classify products in a company’s product portfolio into four categories (Stars, Cash Cows, Question Marks, and Dogs);

- index a company’s product portfolio according to the cash usage and generation;

- determine the priority that should be given to different products in a company’s product portfolio; and

- develop strategies to tackle various product lines.

3. BCG matrix explained

The idea behind the growth share matrix is that the amount of cash that a product uses is proportional to the rate of growth of that product in the market, and the generation of cash is a function of market share for that product.

Money generated from high-market-share/low-growth products is used to develop high-market-share/high-growth products, and low-market-share/high-growth products.

Under the BCG matrix, products are classified into four business types:

- Stars are leaders in high growth markets. Stars grow rapidly and therefore use large amounts of cash. Stars also have a high market share and therefore generate large amounts of cash. Over time, the growth of a product will slow. So, if a Star maintains a high market share, it eventually becomes a Cash Cow. If not, it becomes a Dog.

- Cash Cows are highly profitable, and require low investment because they are market leaders in a low-growth market. Growth is slow and therefore cash use is low, and market share is high and therefore cash generation is high. Money generated from cash cows is used to pay dividends, interest, and overheads, and to develop Stars and Question Marks.

- Question Marks are the real cash traps and gambles. Question Marks grow rapidly and therefore use large amounts of cash. However, they do not have a dominant market position and hence do not generate much cash.

- Dogs generate very little cash because of their low market share in a low growth market. BCG refers to these products as cash traps. Although they may be sold profitably in the market, Dogs are net cash users and BCG indicates that, in terms contributing to growth, they are essentially worthless.

4. Available strategies

- Develop: The product’s market share needs to be increased to strengthen its position. Short-term earnings and profits are forfeited because it is hoped that the long-term gains will outweigh these short term costs. This strategy is suited to Question Marks if they are to become Stars.

- Hold: The objective is to maintain the current market share of a product. This strategy is often used for Cash Cows so that they continue to generate large amounts of cash.

- Harvest: Under this strategy, management attempts to increase short-term cash flows as far as possible (e.g. by increasing prices, and cutting costs) even at the expense of the products long-term future. It is a strategy suited to weak Cash Cows or Cash Cows that are in a market with a limited future. Harvesting is also used for Dogs, and for Question Marks that have no possibility of becoming Stars.

- Divest: The objective of this strategy is to get rid of unprofitable products, or products with a low market share in a low growth market. Money from divestment can then be used to develop and promote more profitable products. This strategy is typically used for Question Marks that will not become Stars and for Dogs.

For more information on consulting concepts and frameworks, please download “The Little Blue Consulting Handbook“.

Image: Flickr

One reply on “BCG Growth Share Matrix”

[…] or else it should probably stop selling them. The same year BCG also developed its now famous growth share matrix, a framework that recommends allocating resources within a firm towards products that are, or are […]