The profitability framework can help executives, consultants and entrepreneurs to diagnose and respond to falling prices, declining sales volume, or rising costs

BUSINESSES sometimes experience reduced profitability.

This is not necessarily a problem if the decline was expected because a business is sustained from cashflow, not profit, and long term growth can be pursued through capital appreciation, which shows up on the balance sheet and not on the profit and loss statement.

However, a drop in profits can be concerning if it is unexpected and unexplained. It can limit a business’s ability to achieve organic growth and may mean that its existing business model is no longer sustainable.

In order to remedy the situation, the executive team will need to find out what is happening and why, and will sometimes engage management consultants to help them understand and respond to the problem more quickly and effectively.

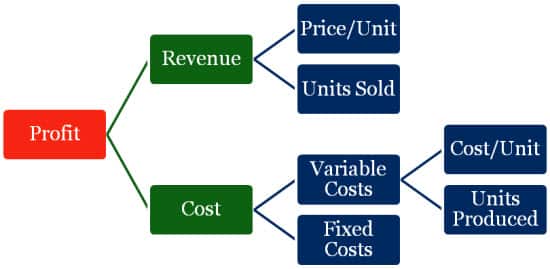

1. Profit

Profit equals revenue minus cost. (yep, so far so good)

By investigating each branch of the profit equation, revenue and cost, and drilling down to explore a business’s current and historical performance figures (e.g. revenue, price per unit, units sold, product mix, segment mix, and gross margins) you will be able to discover the source of declining profitability. It may result from a falling price per unit, declining units sold, rising costs, or a combination of the three.

If you realise that a branch or sub-branch of the profitability framework is not the problem, then you can simply come back up a level and examine the remaining branches.

By comparing the business’s performance numbers with the competition you can also determine whether the problem is company specific or industry wide.

2. Revenue

Revenue can come from various sources including advertising and product sales, but is normally thought of as being a function of price per unit and units sold. For example, price per widget multiplied by the number of widgets, or cost per click (CPC) multiplied by the number of clicks of a website ad.

Declining revenue can derive from a fall in prices or a reduction in units sold, and can be looked at in four stages:

1. Segment: The total revenue number is likely to hide important details, and so you may want to segment units sold into its component parts. There are lots of ways to do this, including by:

- Product

- Product line

- Distribution channel

- Region

- Customer type (new/old, big/small)

- Industry vertical

2. Examine: Compare current and historical numbers in order to find the trend and identify the source of the problem. For example, you might discover that the price of widgets in America has fallen.

3. Diagnose: Once you know what is happening, you also need to figure out why. For example, did a new low cost competitor like Walmart enter the market?

4. Respond: Once you fully understand the source of the problem, you can then develop a strategic response.

2.1 Falling Prices

If you discover that declining revenue results from falling prices, there could be a number of explanations.

Diagnosing falling prices

Although you may know that prices have fallen, you might not know why this has happened in the context of the marketplace, and you need to figure this out before you can devise a plan of action.

In examining the business situation, you will want to consider the customer, the product, the competition, and the company itself.

If falling prices turn out to be an industry wide problem, then you can explore the competitive dynamics of the industry and may discover that the issue results from:

- Increased competition (for example, entry into the market of a new low cost competitor like easyJet),

- Increase in the number of substitutes,

- Reduced barriers to entry (for example, the Internet has enabled new entrants in the markets for book stores, newspapers, and taxis),

- Increased buyer bargaining power (for example, Amazon has used its market dominance to drive down the price of books much to the chargrin of book publishers), or

- Decreased supplier bargaining power (for example, excess supply of American shale gas forces all suppliers to lower prices).

Responding to falling prices

You would be forgiven for thinking that the best way to respond to falling prices is simply to raise them. But unfortunately things are not that simple. A business’s ability to raise prices can often be constrained.

Before responding to falling prices, a business should consider the following issues:

- Market Power: Does the business have market power as a monopoly or oligopoly producer? For example, De Beers had (and largely still has) a monopoly on the diamond trade which allows it to keep the price of diamonds high.

- Competitor Pricing: Have competitors changed their prices? How does the business’s product mix, product quality, and cost structure compare to the competition?

- Customer Price Sensitivity (or “price elasticity of demand”): A business has to think not only about its competitors but also about its customers, who will normally respond to higher prices by demanding less. If customers are very price sensitive (e.g. students) then higher prices may result in lower revenues.

- Price Discrimination: Can the business distinguish between customers and charge different prices for the same product? This could be done by offering quantity discounts, or by distinguishing between people in different groups (e.g. students) or in different locations (e.g. you pay more for popcorn at the cinemas).

- Product Differentiation: Is there something different about the product that might allow the business to raise prices? For example, a trusted brand, appealing design, unique product features, or strong customer service.

2.2 Declining Sales Volume

If prices are not the issue, then declining profitability may have been caused by declining sales volume.

Diagnosing declining sales volume

Declining sales can result from:

1. External factors (see Porter’s Five Forces and PEST Analysis):

- Increased value for money of substitute goods due to lower prices or improved quality

- Reduced value for money of complementary goods due to higher prices or reduced quality

- Increased competition

- Reduced barriers to entry

- Shrinking market size

- Political upheaval

- Shrinking size of the regional, national or global economy

- Changes in consumer demographics or consumer preferences

- Introduction of new disruptive technologies

2. Internal factors (see Value Chain Analysis):

- Supply chain bottlenecks

- Limited operating capacity

- Restricted access to distribution channels

Responding to declining sales volume

Faced with falling sales, there are a number of ways that a business can respond, for example:

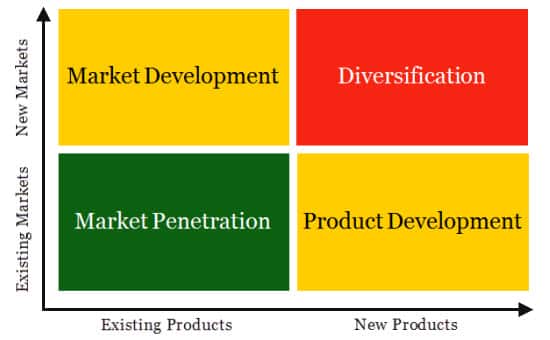

- Market penetration: increase market share or grow the size of the market by using various marketing strategies focused around pricing, product differentiation, promotion, and product placement (see Four P’s Marketing Framework),

- Market expansion: expand into new markets in order to sell existing products to new customers,

- Product development: develop new products for existing customers, or

- Diversification: develop new products to be sold in new markets.

3. Costs

The third driver of declining profitability is rising costs.

Diagnosing rising costs

If your examination reveals that rising costs are the problem, then you will need to inspect the cost structure of the business in order to locate the source of the cost blow out.

A few questions that you may want to ask:

- Does it make sense to segment costs using the value chain? For example, raw materials, procurement, operations, distribution, customer service.

- What are the business’s fixed costs? For example, Sales General & Admin, overheads, rent and interest expenses, depreciation, capital costs, R&D, and wages under fixed employment contracts.

- What are the business’s variable costs? For example, raw materials, shipping, energy, and wages based on commission or performance bonuses.

- What are the main cost drivers?

- How have costs changed over time?

- How does the business’s cost structure compare with the competition?

Responding to rising costs

After determining the source of rising costs, you then need to figure out how to respond.

Here are three questions to think about:

- How long will it take to reduce major cost drivers?

- Are the activities strategically important?

- To what extent do the activities contribute to operational performance?

The method that you employ to reduce costs will depend on the situation.

You may want to consider the following common cost reduction techniques:

- Improve the utilisation rate of plant, property and equipment (PP&E)

- Consolidate procurement across business units

- Outsource manufacturing to China/India/other

- Relocate operations to lower cost cities, regions or jurisdictions

- Partner with distribution companies (e.g. FedEx)

- Use IT and digital channels to reduce communication and organisational costs

- Eliminate costly activities that have low contribution to operational performance and low strategic importance

4. Profitability Framework Cheatsheet

As a bonus for aspiring consultants (and perhaps also as a refresher for practicing consultants and business leaders), we have prepared a one page profitability framework cheatsheet to help you understand and use the framework.

You can download it here.

For more information on consulting concepts and frameworks, please download “The Little Blue Consulting Handbook“.

Image: Flickr